Dear BLUE users,

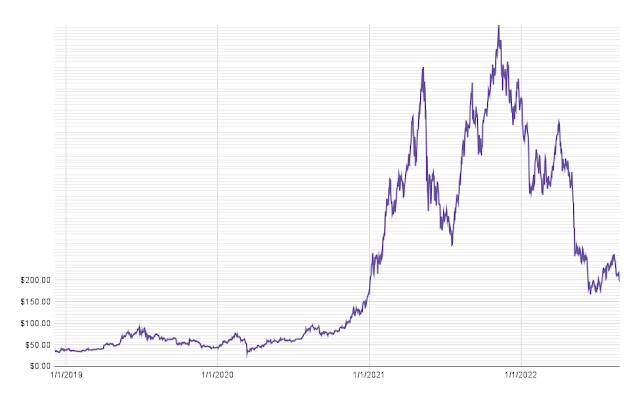

BLUE had a negative week, falling from $213.76 to $195.29, for a drop of 8.64%.

Traditional and crypto markets fell last week, due to the announcement by the Federal Reserve in the United States to continue increasing interest rates.

You may also listen to this weekly update at our podcast BlueTeko.

What happened?

On Friday, the US Federal Reserve Chair. Jerome Powell, announced that interest rates will continue to increase to stop inflation. Analysts expect an increase in September of 75 basis points. The announcement created instability in the markets, with investors fearful on its effects on the economy. The S&P 500, Dow and Nasdaq all had large losses.

In more positive news, the Ethereum Foundation confirmed the dates for the Ethereum 2.0 merge, which will take place from September 6th to the 20th. The crypto industry is expecting the merge to be a positive catalyst for a market recovery.

What’s next?

We expect more volatility this month due to the effects of interest rates on the US American economy. Even though the crypto market is struggling, it is worth noticing that the current bear market is on track with the 2018 bear market, and prices might be reaching their bottom. According to arcane research, the “current bitcoin drawdown has lasted for 286 days, and we are currently down 70% from the all-time high. The 2018 and 2014 bear markets lasted for 12-13 months, with maximum drawdowns of 85%.” Markets are cyclical, which is why we remain positive in the medium to long term.

BLUE starts this week at $195.29(USDT), a gain of +393.53% since its inception.

Baron Rothschild made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon.Although insensitive, this phrase lives on as the basis of contrarian investing. Technical analysis shows BLUE at a support zone.

BLUE is currently 75% down since its all-time high. Is this a misfortune …or an opportunity?